Not unlike healthcare and finance, the insurance industry has undergone a tremendous shift towards digital technologies since the start of the COVID-19 pandemic. While the coronavirus is generally thought to be the primary catalyst for these hastened reforms, the changes themselves can largely be attributed to advancements in technology, evolving customer expectations, and the looming prospect of substantial competition from insurtech startups.

Despite the fact that consumers have largely embraced digital channels and tools in the wake of COVID-19, the vast majority of insurers have been slow to adopt and implement the emerging technologies that have propelled so many adjacent industries into the modern era of user experience. Whether it’s a result of outdated compensation practices, legacy IT systems, or just a general aversion to change, the fact of the matter remains that many insurance companies are simply not evolving quickly enough to meet the rapidly changing needs of their customers in a post-pandemic world.

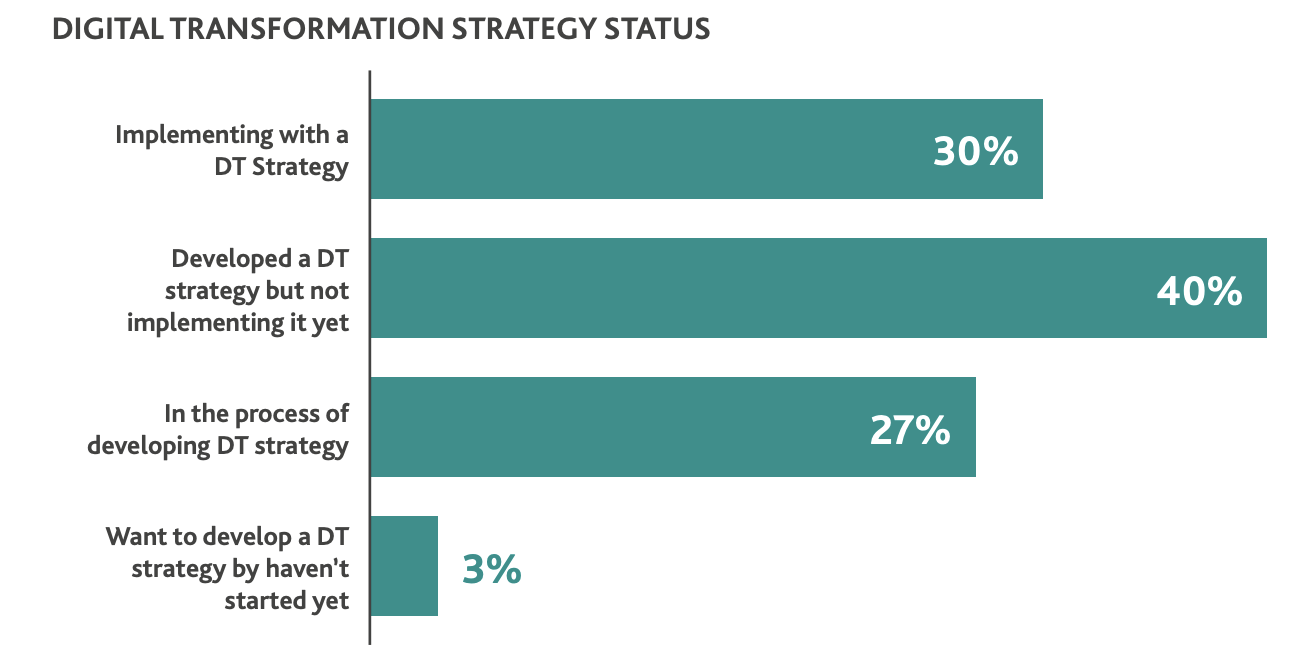

A recent survey conducted by BDO has revealed that although 97% of financial institutions have a digital transformation strategy in place or in development, only 30% are actually implementing it.

Source: 2021 Financial Services Digital Transformation Survey

It has become abundantly clear over the past several years that digital transformation is not an optional process for companies operating within the insurance industry who aim to succeed in this rapidly evolving landscape.

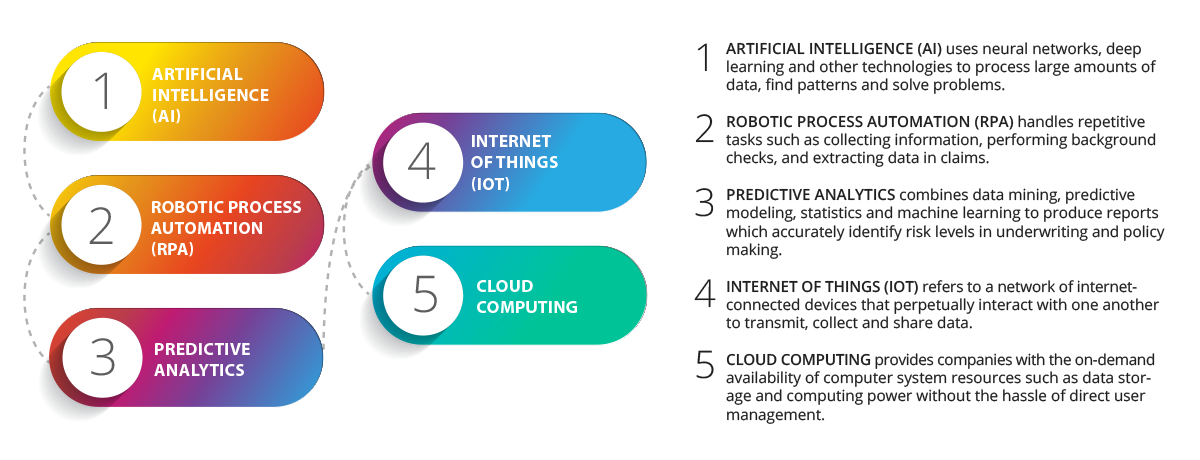

Modern breakthroughs in digital technology have largely facilitated this recent transformation sweeping across the insurance industry.

By taking advantage of these technologies, insurance companies can effectively increase productivity, automate core business operations, reduce costs, and enhance the customer experience.

The first and most easily observable impact of digital transformation on insurance is the efficiency it enables. Primarily powered by artificial intelligence and related technologies such as machine learning and predictive analytics, almost every aspect of insurance operations has been optimized for speed. Claims can now be instantly processed via mobile applications, policy writing can be done more quickly and efficiently with machine learning capabilities, and digital assistants are helping customers in real-time when they truly need it most.

The most heavily cited use case of digital transformation facilitating efficiency within the insurance industry is the optimization of claims management and processing. Effective claims management is arguably the most crucial component of an insurer’s capacity to protect their customers and themselves. The process is long and multi-faceted, and each step provides an additional opportunity for human error and subsequent customer frustration.

When claims are processed inefficiently, it can negatively impact both the customer who is likely relying on the claim payment to ideally recover their losses, as well as the insurance company – who may not catch certain instances of fraud – resulting in financial losses. To ensure success in this element of operations, many carriers are taking advantage of new claims technologies and moving towards digital claims processing in hopes of eliminating any semblance of inconsistency and inefficiency.

Claims processing consists of several layers including review, adjustment, investigation, and remittance or denial of the claim. For each layer, insurers must process a substantial volume of documents, which can be expedited with the use of document automation tools. Using these tools in conjunction with claims-management software, insurers can automatically identify fraudulent claims, extract data from documents and validate claims that are in line with policies.

Digital claims technology also allows insurers to streamline traditionally disjointed claims management practices, which results in dramatically faster processing and a significant reduction in claims cycle times. For example, Tractable harnesses the power of AI to interpret automotive accident images and estimate repair costs in real-time, enabling insurers to respond to accidents and settle claims up to 10 times faster. By implementing dynamically guided workflows and automation, claims can be processed in a fraction of the time, thereby enabling agents to divert their attention and efforts towards delivering positive outcomes.

Digital transformation is also enabling the insurance industry to become more agile and scalable at both the front and back end of operations. While the industry as a whole has been historically anachronistic and slow to make changes, digital technology has made it more flexible and capable of meeting modern demands.

On the front end of things, customers have constant access to service anytime and anywhere via self-service dashboards and apps. Insurers can subsequently collect valuable data from customers via IoT-enabled devices and wearables. Then, on the back end, this technology can be collected in order to help brokers and insurers make more accurate decisions when it comes to underwriting, policies, and new product offerings.

Many insurance companies are turning to automated insurance underwriting to expedite processes that would otherwise take significantly longer to complete manually while simultaneously removing the chance of human errors. Human underwriters require a massive amount of paperwork, ranging from bank statements, to tax returns, to medical records, and more. Once the client is able to obtain and provide the underwriter with this information, the underwriter then needs to assess the potential risk in providing insurance to the client.

Automated insurance underwriting describes the process where artificial intelligence and robotic process automation software underwrites the risk of potential clients. Insurers can harness this relatively new technology to evaluate risk, and subsequently decide how much coverage a client should receive and how much they should pay for it.

Automated insurance underwriting takes advantage of advanced AI and ML technology in conjunction with the insurance company’s underwriting guidelines in order to determine whether to accept the risk presented by a client. This enables providers to generate a profit from underwriting while enhancing customer satisfaction through increasingly personalized policies and creating a sense of uniformity with regards to standards for coverage.

Finally, and perhaps most importantly, digital transformation has empowered insurers with the necessary tools to create an optimized and personalized customer experience. In recent years, personalization has become the status quo throughout nearly every sector. And while the insurance industry as a whole has been slow to adopt these changes, individualizing the experience can be nearly as beneficial to insurers as it is for customers.

Artificial intelligence and machine learning are promoting a seamless personalized experience for brokers and customers alike. Digital technologies are providing customers instant feedback and empowering brokers to do their jobs more effectively and efficiently. Digital transformation in the insurance industry is also helping to individualize marketing efforts. Modern data analytics and ML systems can target and tailor marketing efforts for insurers, harnessing the power of social media to reach audiences they can genuinely make a lasting impression on.

Digitization has been a gradual and difficult process for the insurance industry, but there are countless, significant merits to undertaking digital transformation for companies who are willing to go the extra mile for their customers. Those who are unwilling or too slow to adapt risk falling into obsolescence at the hands of up and coming digital-native insurtech startups.

Simply put: customers have grown accustomed to digital processes when it comes to managing products and services, and expectations are at an all-time high. The evolution of customer experiences across every industry has influenced market expectations in the insurance sector, and companies who aren’t able to satisfy or surpass these standards will eventually lose their market share to more agile and efficient, customer-centric competitors.