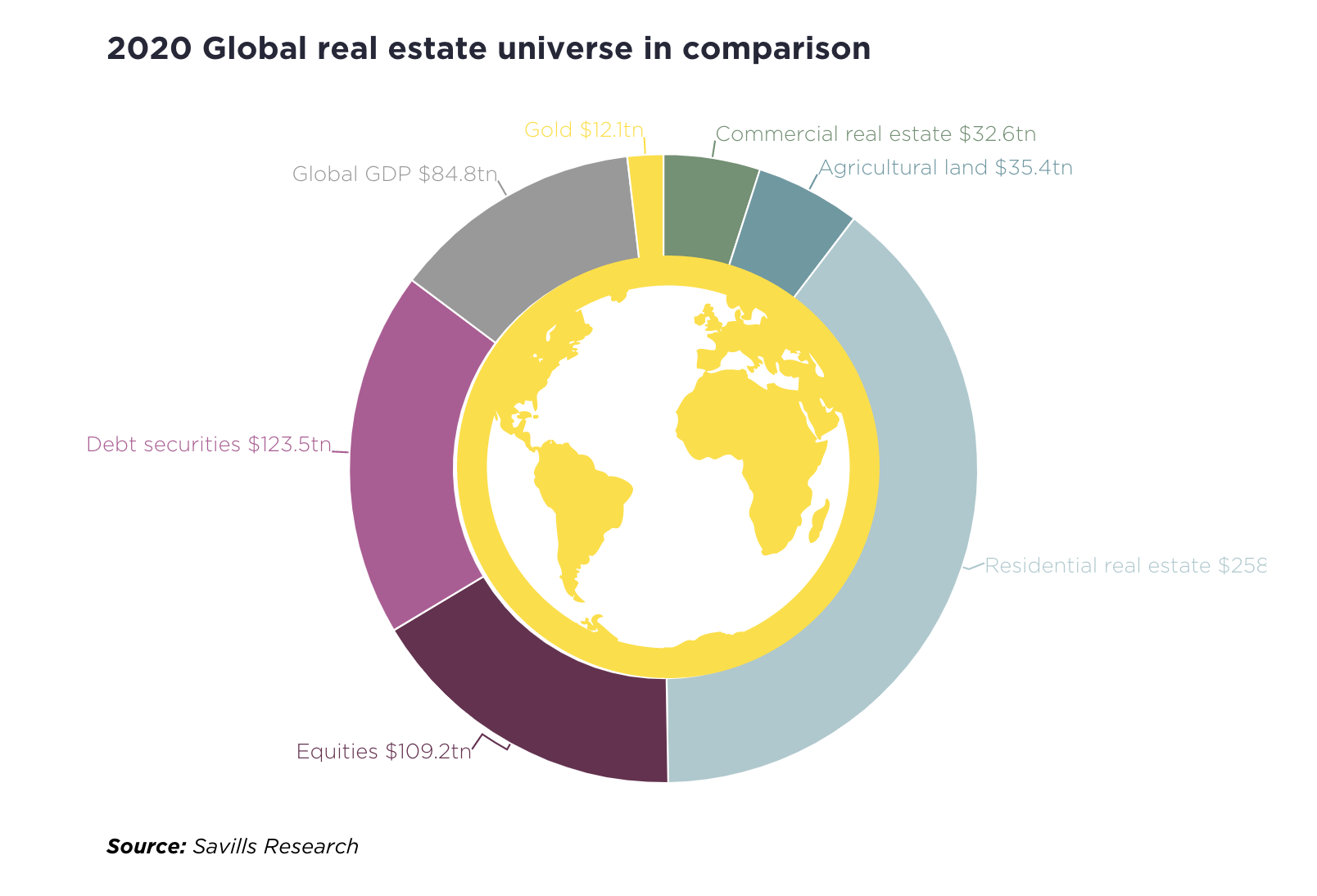

Valued at $326.5 trillion, real estate is the world’s largest global asset class, i.e. it is worth more than all global equities and debt securities combined and it is almost four times the global GDP. The biggest sector is residential property, accounting for 79% of all global real estate value. These are the findings from new research conducted by Savills.

In addition to being the concentrate of wealth, the real estate industry is also known for being slow to adopt new technologies and implement digital transformation initiatives. However, over the past couple of years real estate companies started to embrace automation and digitalization as a way to stay competitive, giving rise to property technology, or PropTech. According to KPMG, property organizations invest in PropTech to improve efficiencies (65%), decrease costs (47%) and support decision-making (44%).

A notable example of real estate solutions that help companies streamline operations and make informed decisions are real estate valuation engines. Let’s see how they work.

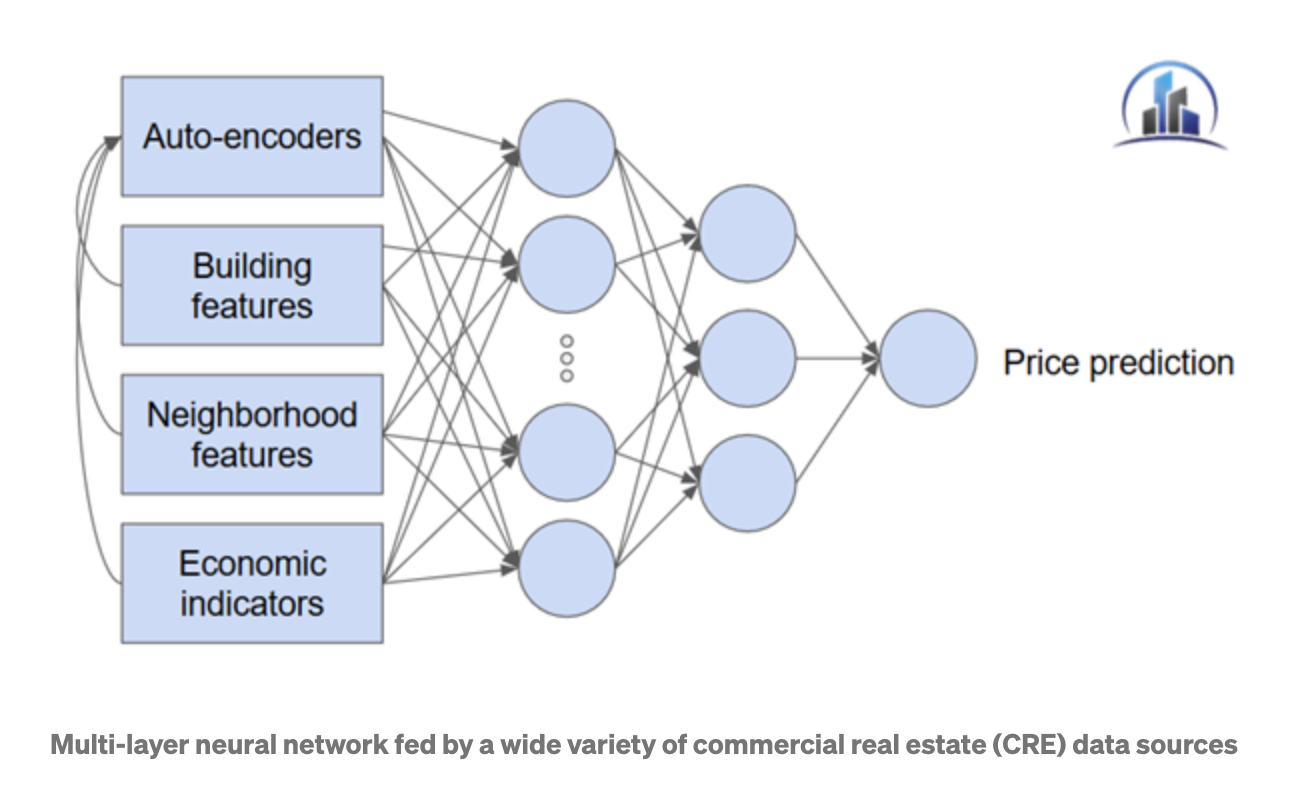

Real estate valuation engines, also known as automated valuation models (AVM), are software tools that leverage mathematical and statistical modeling techniques to provide an estimate of property value. To arrive at these estimates, valuation engines use a variety of informational sources, like property characteristics, geographic location, price trends, market research, public databases, and others.

Source: Medium

Depending on the purpose and underlying models, there are several approaches employed by automated valuation models:

Property companies, brokers, agents and other industry players that embrace technology stand to benefit in multiple ways. From faster and more accurate decisions to better risk management, real estate valuation engines are changing the face of real estate as we know it.

As with all automation systems, one of the main AVM benefits is reducing manual efforts and streamlining the end-to-end process. Real estate valuation engines can make thousands of calculations and comparisons — all in a fraction of time it would take a human agent. Thus, real estate brokers can quickly run valuations of properties that are up for sale and prepare a list of potential options for their clients with minimum effort.

Valuations are necessary not only for the purpose of selling or buying real and commercial estate. Mortgages and home equity lines of credit, too, require an accurate estimation of property value that provides a collateral to secure a loan. AVMs take into account much more information and are sensitive to a wider range of evidence. By leveraging real estate valuation engines, lenders and investors can better assess the level of risk associated with the lending decisions both at the time of origination and throughout the life of the loan.

In 2019, the global home insurance market was valued at $225.42 billion, and the industry is expected to amass $395 billion by 2027, growing at a CAGR of 7.3%. Property insurance underwriting is a complex process with multiple factors at play, and accurate property estimation is one of them. To adequately determine insurance policy rates and premiums, insurance carriers require property appraisal, which can be a lengthy process. Integrating AVMs into existing workflows allows insurers to get valuations faster and at a lower cost, without compromising accuracy. Given that insurers often need to manage large portfolios, automated property valuation can significantly accelerate workflows and translate into cost savings.

An important source of fiscal revenue, a property tax system relies on complex policies and regulations as well as valuation mechanisms and methods. Mass appraisal is one of the commonly accepted tools used to determine value of a group of properties as of a given date. By enabling efficient, large-scale valuations that can be carried out within a short period of time, AVMs can support the core processes of real estate taxation.

Every investment decision, whether related to real estate or commercial property, requires meticulous analysis of available data in order to minimize associated risks. Any mistake or potential bias can influence an investor’s decision and result in serious repercussions like lost revenues. Real estate valuation engines that are properly trained on high-quality data are far less susceptible to errors or judgment bias, helping investors make better investment decisions on the real estate market.

Although automated valuation models have only started making a name for themselves, the efficiency they bring and results they provide today do not go unnoticed. Whether assessing a property or a portfolio of properties for real estate investments and taxation purposes or providing accurate value estimates to support low-risk lending and mortgage decisions, real estate valuation engines empower human agents with the right capabilities to make smarter, faster, and more informed decisions. With further advancements in machine learning and big data analytics, real estate valuation engines have the potential to revolutionize traditionally cumbersome property management processes.