IRS Modernization and Taxpayer Expectations: Is Your Firm’s Software Ready?

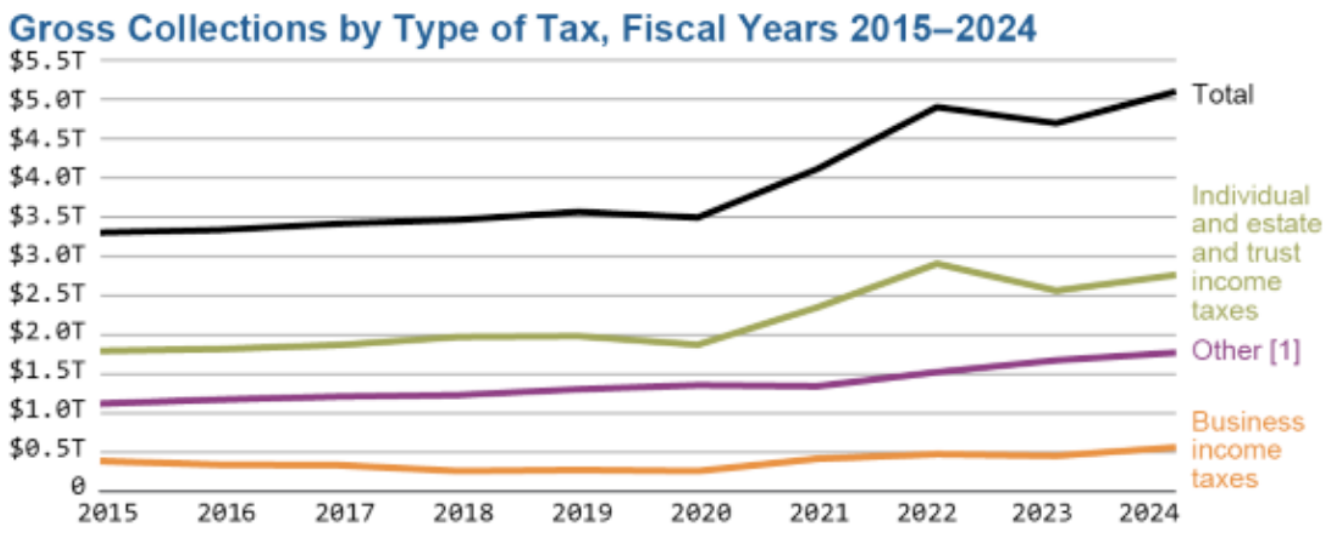

The Internal Revenue Service is undergoing a major transformation. The changes go far beyond a routine upgrade: they replace the technology that handles 267 million tax returns and generates $5.1 trillion each year.The Inflation Reduction Act, together with the pressing need to retire 1960s-era systems, has pushed the agency into a multi-year, multi-billion-dollar effort.

Tax firms should see this shift as a turning point. The IRS plans to move to real-time processing, digital communication and API-based data sharing, which means the software they depend on must keep pace. Continuing to use outdated platforms that cannot talk to the new IRS will cause workflow bottlenecks, raise security concerns, and put firms at a market disadvantage.

Source: IRS

Source: IRS

Why is the IRS undertaking such a massive modernization?

Calls to modernize the IRS have been around for many years. The present effort, however, is fueled by a mix of serious problems and fresh opportunities that make the overhaul unavoidable.The Legacy System Crisis

Deep inside the agency lie some of the oldest computer systems in the federal government.The Individual Master File, which holds every individual taxpayer’s record, runs on COBOL, which is a language that dates back to the Eisenhower years. The Business Master File and the Integrated Data Retrieval System also trace their origins to the 1960s. Depending on such old technology brings serious problems. Fewer programmers know how to work with COBOL, which the Government Accountability Office describes as a “single point of failure” – a situation where a single staff member is responsible for a vital function. The weakness became obvious on Tax Day 2018, when a hardware glitch in the IMF halted services and stopped electronic payments on the most hectic day of the tax calendar.Operational Inefficiency

Even when it works, the old system is slow and costly. The National Taxpayer Advocate has labeled the agency’s dependence on paper processing as its “kryptonite,” causing delays, more mistakes, and huge backlogs. In addition, the IRS operates roughly 60 separate case-management systems that do not talk to each other, meaning agents must jump between databases to piece together a taxpayer’s full picture.Evolving Taxpayer Expectations

People now use digital banking and expect instant transactions, so they also look for fast service from the government. The IRS’s modernization plan admits that batch-processing cannot meet the demand for real-time data and client-focused services. Tax advisors and their clients want secure online accounts, immediate access to information, and rapid issue resolution which is something the legacy infrastructure cannot deliver.What are the key pillars of the IRS modernization plan?

The agency lays out its roadmap in the Strategic Operating Plan and the earlier Integrated Modernization Business Plan. Both documents group the effort into four main pillars that touch everything from taxpayer-facing tools to the core processing engine.Enhancing the Taxpayer Experience

- Online Self-Service: Broaden what taxpayers and tax pros can do in their online accounts, including secure viewing and editing of data.

- Digital Communication: Roll out taxpayer digital communications to send notices and letters to a protected online inbox, cutting down on paper mail.

- Live Assistance: Deploy tools such as callback options to shorten hold times, and test new channels like live chat and video help.

Modernizing Core Tax Processing

- Retiring the IMF: The Customer Account Data Engine 2 (CADE 2) program will set up a fresh, authoritative source for taxpayer accounts, while the Individual Tax Processing Engine (ITPE) will rewrite old code in modern languages such as Java.

- Real-Time Tax Processing (RTTP): This effort will let the IRS handle data the moment it arrives, so taxpayers can track their return’s status live and make edits online.

- Unified Case Management: The Enterprise Case Management (ECM) solution will consolidate the more than 60 siloed systems into a single platform, giving staff a full view of each taxpayer’s interaction.

Upgrading IRS Operations and Technology

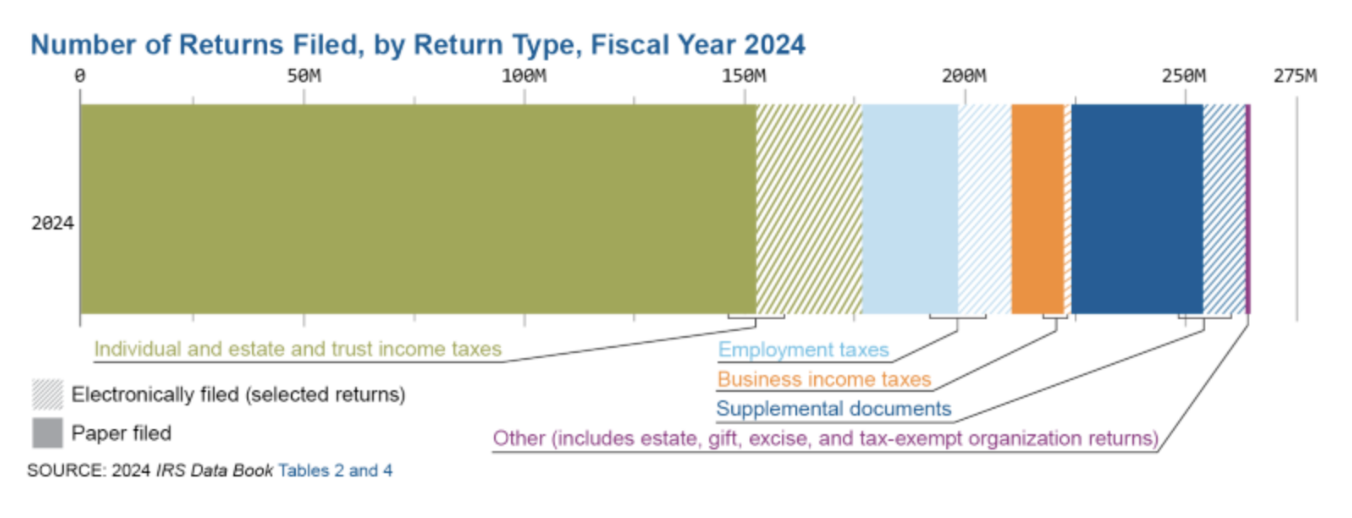

To make these features possible, the agency is overhauling its internal tech stack. A key part of that effort is the Paperless Processing Initiative, which seeks to convert every paper-filed return into digital form. The IRS is also moving many services to cloud platforms to gain scalability and efficiency, and it is deploying APIs to enable secure data exchange with approved partners. The rise of electronic filing highlights the necessity of modern, real-time processing systems.

Source: IRS

The rise of electronic filing highlights the necessity of modern, real-time processing systems.

Source: IRS

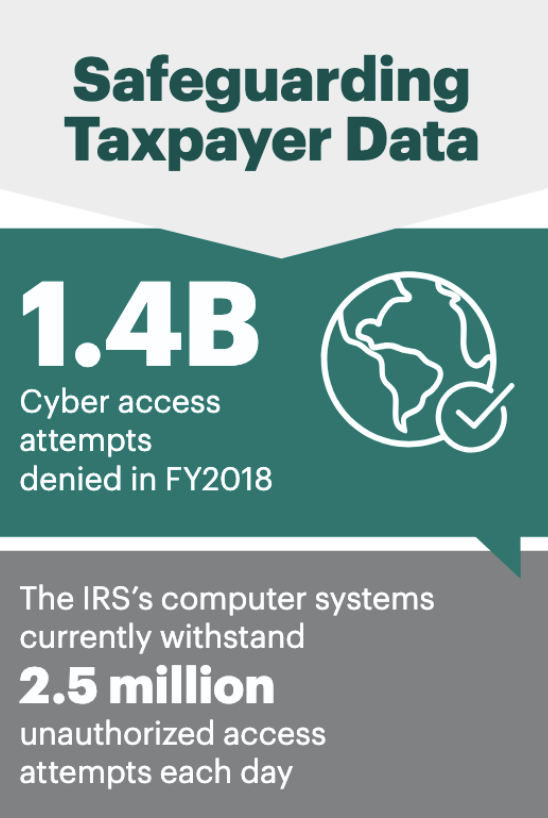

Strengthening Cybersecurity and Data Protection

The IRS faces more than 1.4 billion cyber-attack attempts each year, so security sits at the core of the upgrade. The strategy calls for tighter identity and access management, proactive handling of vulnerabilities and threats, and continuous monitoring that covers the entire data flow to guard taxpayer information. Source: IRS

Source: IRS

What challenges complicate these modernization efforts?

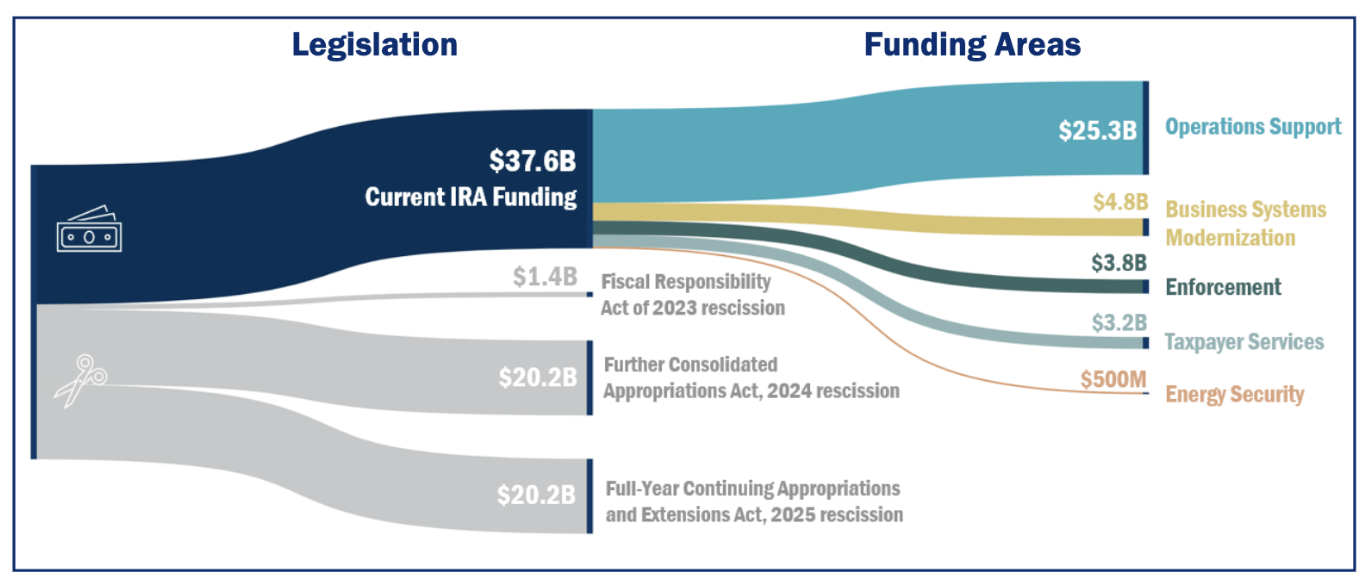

The plan is bold, and it runs into two big obstacles: shaky funding and a shrinking workforce. The Inflation Reduction Act originally earmarked almost $80 billion for the effort, yet by March 2025 legislation cut that number to $37.6 billion. The IRS commissioner has warned that some of the modernization money may have to be redirected to keep daily operations running. At the same time, the agency’s staff numbers are falling. Legislation and IRS funding by area.

Source: Treasury Inspector General for Tax Administration

A May 2025 report from the Treasury Inspector General for Tax Administration shows that over 11,000 employees have either taken deferred resignation or received termination notices. The tally includes a 30% cut in revenue agents and a loss of senior IT personnel hired to drive the overhaul. These overlapping pressures add uncertainty and could push back the schedule for key technology rollouts.

Legislation and IRS funding by area.

Source: Treasury Inspector General for Tax Administration

A May 2025 report from the Treasury Inspector General for Tax Administration shows that over 11,000 employees have either taken deferred resignation or received termination notices. The tally includes a 30% cut in revenue agents and a loss of senior IT personnel hired to drive the overhaul. These overlapping pressures add uncertainty and could push back the schedule for key technology rollouts.

How should your firm’s software prepare for the new IRS?

When the IRS rolls out its new tools, tax firms need technology that can keep up. Clinging to old desktop programs or isolated systems will soon become impractical. Firms should concentrate on four essential capabilities:API Integration Capabilities

The future of tax administration runs on APIs. The IRS is building its new platforms to share data with approved partners via secure endpoints. Your software must be able to connect safely to these APIs, pull client data in real time, verify account status, and submit documents digitally. This capability is an essential piece of any fintech development strategy.Cloud-Native and Scalable Architecture

As the IRS moves its infrastructure to the cloud, your firm’s software should do the same. A cloud-native design gives you the elasticity needed during peak filing periods, lets staff work securely from any location, and aligns your system with the IRS’s emerging ecosystem. Adopting the cloud is a critical step in any successful digital transformation.Support for Advanced Analytics and Digital Workflows

The modern IRS will work heavily with data. Programs like the Return Review Program already use sophisticated analytics to spot fraud, and the new Enterprise Case Management system will create unified digital workflows. To keep up, your platform should provide strong data-analysis tools, offering deeper insight into client files and streamlining internal processes. It should support end-to-end digital workflows from onboarding and document collection to e-filing and correspondence handling.Robust Security and DevOps Practices

With cyber threats on the rise, protecting client data is non-negotiable. Your software must include end-to-end encryption, multi-factor authentication, and proactive threat monitoring. Partnering with a provider that follows modern DevOps practices ensures you can roll out updates, new features, and security patches quickly, without disrupting day-to-day operations.Real-World Example: Modernizing a Tax Consultancy for the SaaS Era

Moving from a traditional service model to a scalable software provider is a hurdle many tax firms encounter. One Kanda client, a consultancy focused on tax credits and incentives, was stuck with an aging legacy platform. The monolithic system cost a lot to upkeep, was hard to upgrade, and forced staff to rely on time-consuming manual workarounds, hurting productivity. Kanda was tasked with building a brand-new cloud-native platform on Microsoft Azure, delivering high availability and on-demand scaling. A major goal was to craft a fresh user experience, with intuitive interfaces that fit the firm’s existing workflows. The outcome was dramatic. The new system boosted operational efficiency, with staff noting quicker response times and a drop in manual effort. Automation, such as AI-driven form processing, streamlined workflows and accelerated processing. Most importantly, the platform’s scalable, multi-tenant design let the firm shift from a service organization to a software provider, paving the way for a SaaS product that unlocked fresh revenue streams and market opportunities.How Kanda Can Help

Dealing with the intricacies of IRS modernization calls for solid technical expertise and a clear strategy. Connecting to new government systems, safeguarding data, and retiring legacy infrastructure pose major challenges for many tax and accounting firms. A partnership focused on custom software development can be a game changer.- Custom, cloud-native platforms: Create secure, scalable, compliant solutions tailored to your firm’s needs, prepared for integration with the IRS upgrades.

- Legacy system modernization: Build robust data-migration pipelines that replace aging applications, smoothing the transition from old to new technology with minimal disruption.

- API-driven, interoperable applications: Design client portals, internal dashboards, and compliance tools that harness APIs for real-time data sharing.

- Security and compliance: Engineer solutions that meet rigorous regulatory standards and safeguard client data throughout your technology stack.

Conclusion

The IRS’s modernization path is a marathon rather than a sprint. Although obstacles remain, the direction is clear: a more digital, real-time, data-focused tax administration. Tax firms can’t afford a “wait-and-see” stance. The ongoing changes are fundamental and call for a proactive technology plan. Companies that commit now to modern, secure, API-ready solutions will be best positioned to reap the efficiencies of the new IRS ecosystem. Embracing updated software lets the tax industry tap into its data’s full potential, delivering faster and more effective service to all.Related Articles

5 Key Steps to Enhance Quality Assurance in Fintech Applications

Today, the financial industry is rapidly changing. From payment processing to wealth management, fintech applications are transforming everything. Between complex financial regulations and the constant threat of cyber-attacks, companies must pay close attention. In response, any new technology needs to maintain both strong security and high quality. According to the American Bankers Association, 93% of…Learn More

Integrating AI-Driven Customer Service and Support in Banking

Imagine a world where you don’t have to wait on hold for your financial question to be answered, or where your personal financial advisor is only a tap away and available 24/7, or where you receive immediate alerts about suspicious transactions. That’s not wishful thinking, that’s what AI-driven customer service in banking looks like. As…Learn More

The Future of FinTech and Banking with AI, ML, and Blockchain

he financial landscape is on the brink of a revolution, fueled by the combination of artificial intelligence, machine learning, and blockchain technology. According to McKinsey & Company, AI alone could contribute an additional $13 trillion to global economic activity by 2030, highlighting the transformative potential of these technologies in finance. What is the current state and…Learn More

Effective FinOps Strategies to Achieve Cloud Cost Efficiency

As organizations embrace the cloud, the pay-as-you-go model offers scalability; however, controlling its costs goes beyond mere management. In this regard, the FinOps framework serves as a beacon for financial and operational brilliance. In this article, we’ll discover what FinOps is, explore its key benefits and principles, and delve into practical FinOps strategies tailored for…Learn More